Powerful Features for Modern Tax Offices

Discover how TOP streamlines every aspect of your tax practice with advanced automation, secure client portals, intelligent reporting, and comprehensive workflow management.

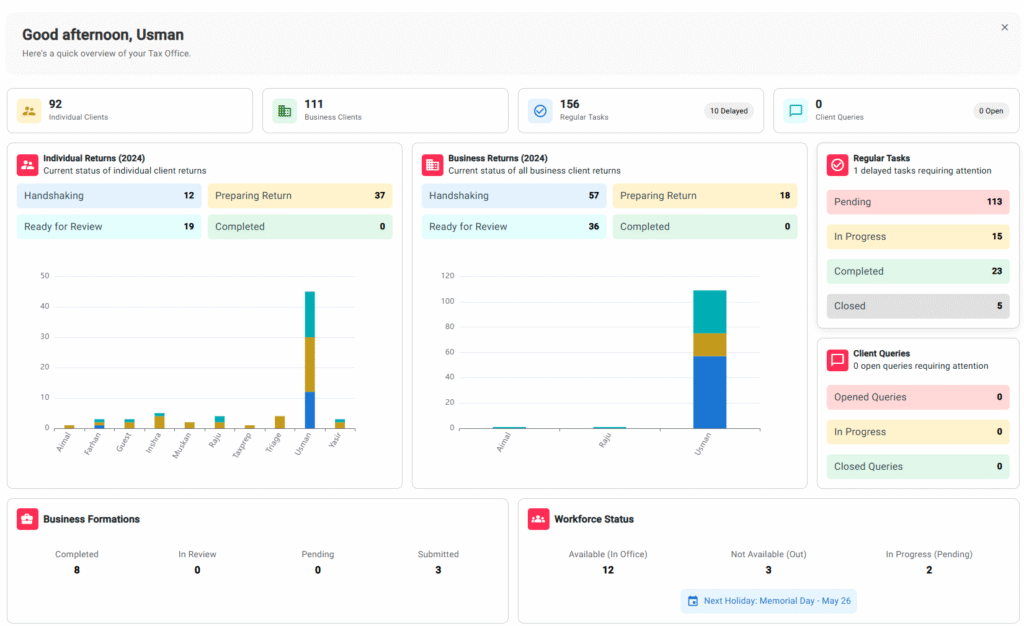

Centralized Dashboard

Our intuitive dashboard gives you a complete, real-time snapshot of your entire practice. View client statistics, track return statuses, monitor tasks, and keep an eye on team performance, all from one central hub.

With clear visuals and organized data, you can instantly identify key areas that need attention, address bottlenecks before they become issues, and stay on top of deadlines. No more switching between multiple systems, everything you need to manage your operations is right at your fingertips.

- Real-time client statistics and return statuses

- Task monitoring and team performance tracking

- Visual bottleneck identification and alerts

- Deadline management and overdue notifications

- Centralized operations management hub

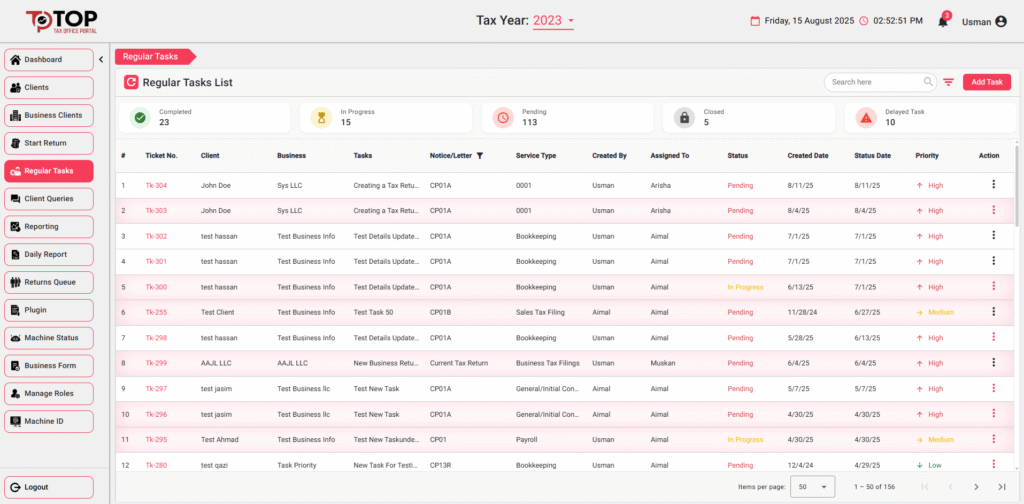

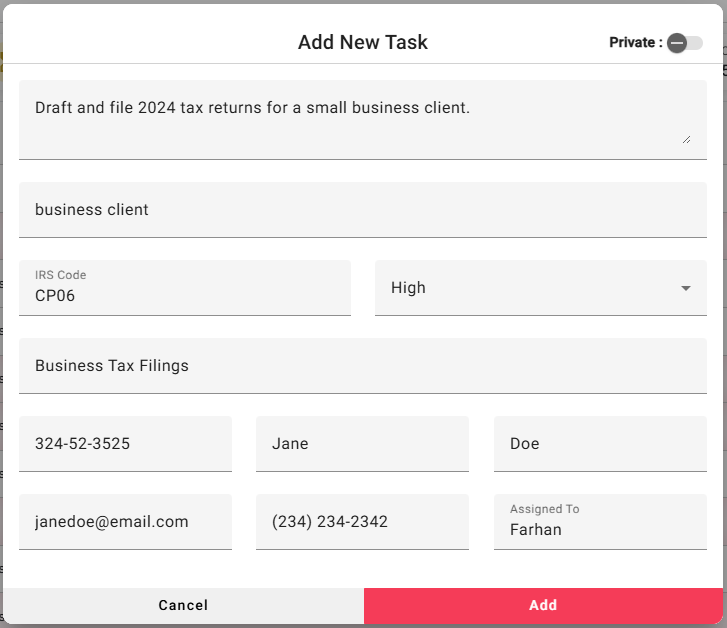

Streamline Workflows

Stay organized and keep your team aligned with our streamlined Regular Tasks section. Assign, track, and manage all recurring or ad-hoc tasks across your practice with ease.

Each task includes its type (e.g., related domain such as bookkeeping, payroll, or tax return) and allows you to attach specific forms like CP 2000 or other supporting documents for quick reference. Team members can add remarks, updates, or instructions directly within the task, ensuring smooth collaboration and clear communication.

- Assign, track, and manage recurring/ad-hoc tasks

- Task categorization by domain (bookkeeping, payroll, tax)

- Attach specific forms like CP 2000 and documents

- View task status, due dates, and assigned preparers

- Overdue item highlighting for timely follow-up

- Team collaboration with remarks and updates

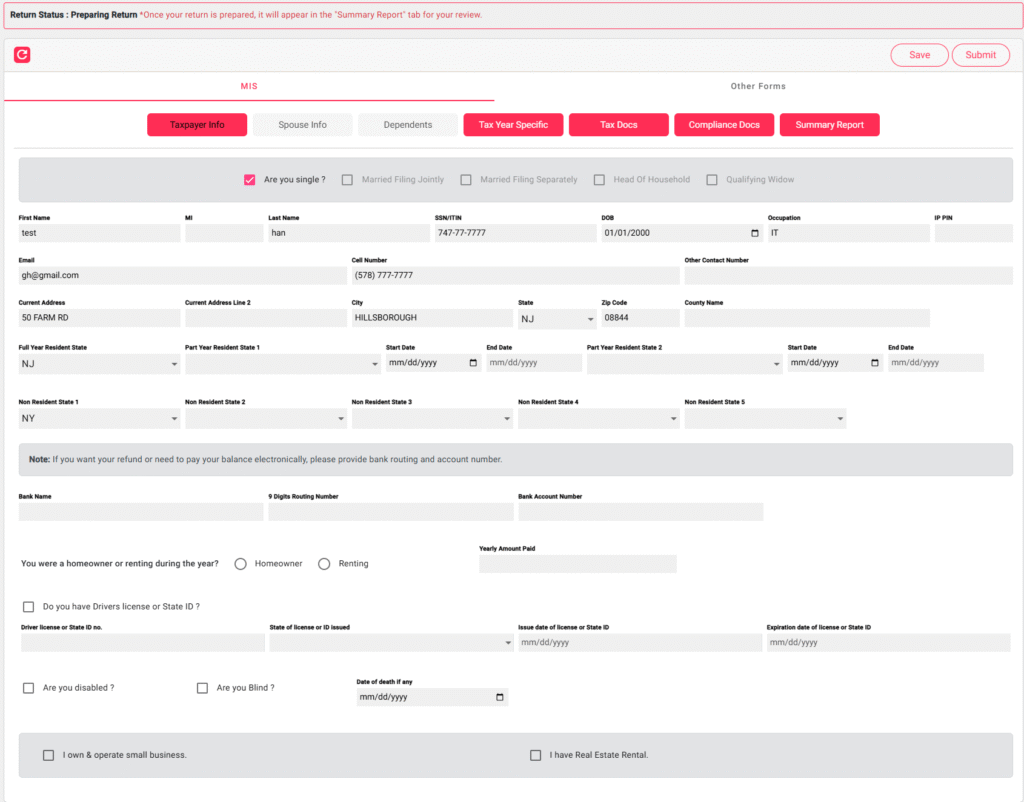

Secure Client Portal

Our Secure Client Portal gives your clients a convenient and protected space to manage their tax filings with ease:

Secure Document Sharing – Clients can confidently provide all required details and upload tax documents through a safe, centralized system.

Real-Time Tracking & Communication – Clients can monitor the progress of their return and easily communicate with your office to ensure timely completion.

Anytime, Anywhere Access – Clients enjoy 24/7 secure access to their tax returns and documents, giving them independence and peace of mind.

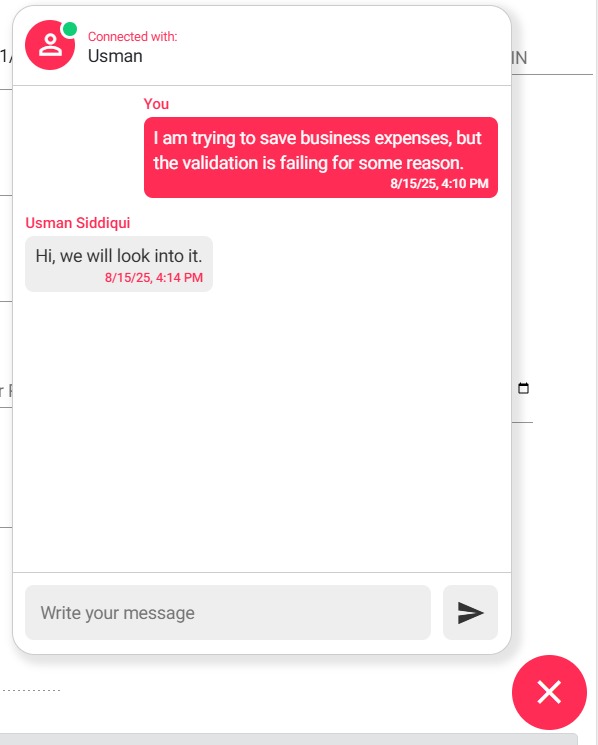

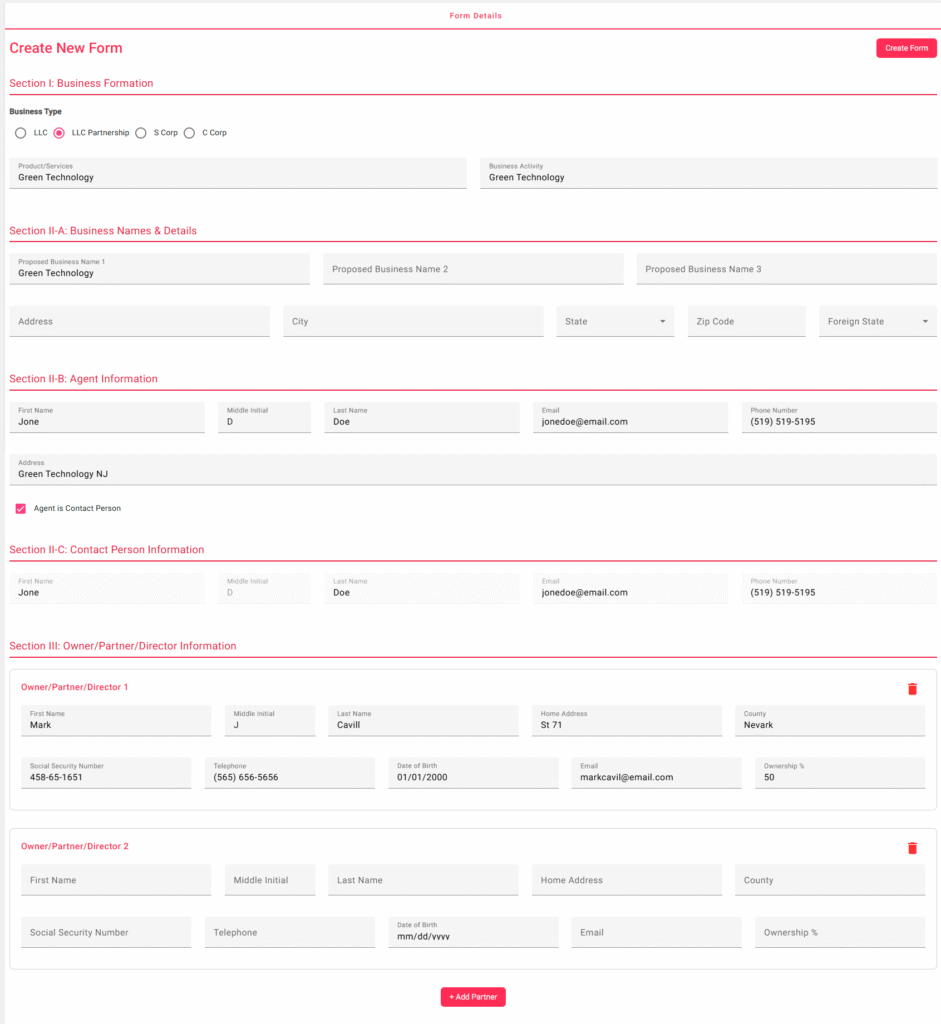

Client Queries Management

Manage and respond to client inquiries efficiently with our dedicated Client Queries section. This feature allows your team to track all incoming client questions, requests, or concerns from a single interface.

Each query includes the client’s name, date of submission, and the full conversation history for complete context. Team members can add internal notes, respond directly to clients, and update statuses for faster response times and improved client satisfaction.

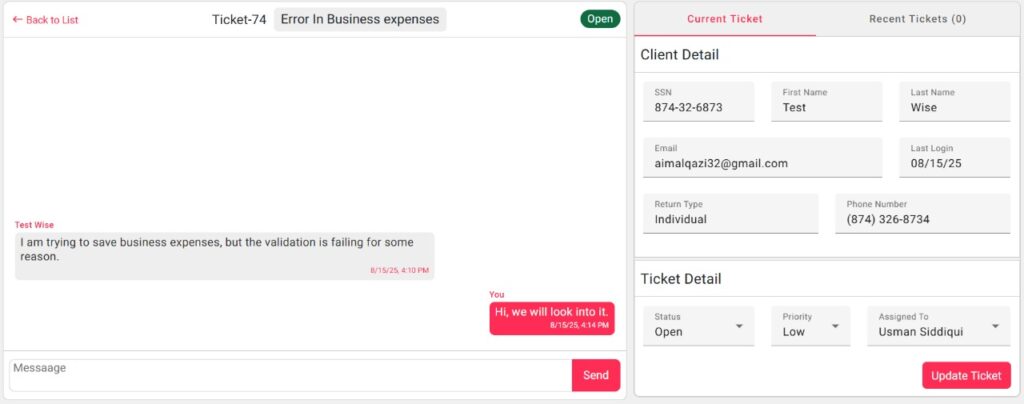

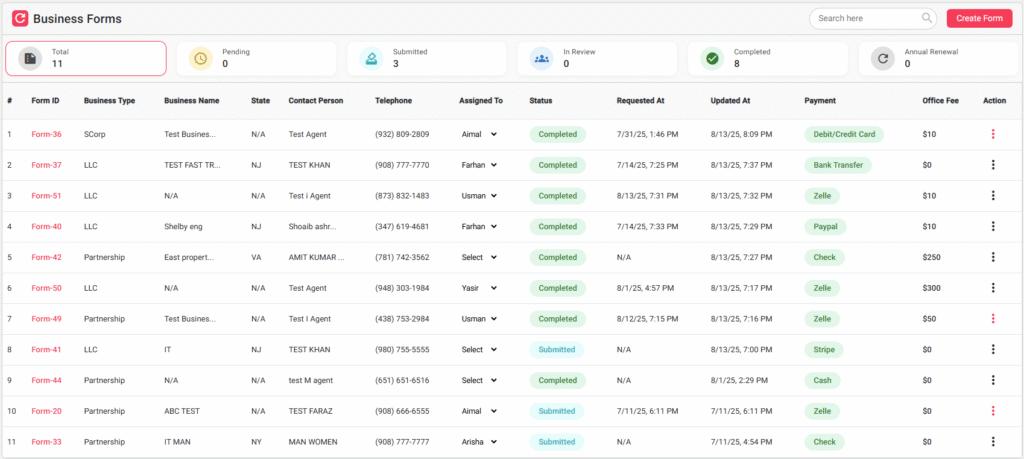

Business Formations

Start and manage new business formations with a streamlined, collaborative process.

Whether your office initiates the process or clients collaborate directly, the system generates unique URLs for secure client access, ensuring accuracy, transparency, and efficiency while keeping all communication and documentation centralized.

In-Office Business Formations

Easily collect and organize all the essential details needed to set up a new business. Our centralized platform streamlines the entire formation process, providing a single hub to manage businesses and securely store all related documents. This ensures efficiency, accuracy, and hassle-free management of business formation activities from start to finish.

Remote Business Formation

Simplify the business formation process with our remote solution. We start by completing the form with only the minimum required details, then provide a secure URL for partners to submit the remaining information safely and conveniently. This approach ensures confidentiality, allowing each partner to share only their own details, while keeping the entire formation process seamless, secure, and efficient.

Realtime Reports & Intelligence

Gain actionable insights into every aspect of your tax office operations with our Intelligent Reporting feature. Reports are organized into four key areas for comprehensive visibility and data-driven decision making.

Track every preparer’s activities on client returns, including changes made, forms handled, submission timelines, and other key actions. This provides full visibility into staff performance and accountability.

Key Insights:

Individual preparer performance metrics

Form handling efficiency tracking

Client return modification history

Submission timeline analysis

View detailed records of all payments and preparation fees for every return. Easily track amounts, payment dates, methods, and associated returns for accurate financial oversight.

Key Insights:

Payment method performance analysis

Fee structure optimization insights

Revenue tracking and forecasting

Client payment behavior patterns

Monitor all activities clients perform within the client portal, including form submissions, return reviews, and status checks. This helps you understand client engagement and identify follow-up needs.

Key Insights:

Client portal engagement analytics

Form submission completion rates

Return review frequency tracking

Status check behavioral patterns

Monitor detailed logs of tax office preparers, including login history, actions taken within the system, and any modifications made to client or business records. This ensures transparency, security, and a complete audit trail.

Key Insights:

User authentication and access patterns

System modification audit trails

Security compliance monitoring

Team productivity analytics

With powerful filtering and search options, these reports allow you to quickly identify trends, pinpoint bottlenecks, and measure team productivity.This data-driven approach helps you make informed decisions, improve efficiency, and enhance client satisfaction.

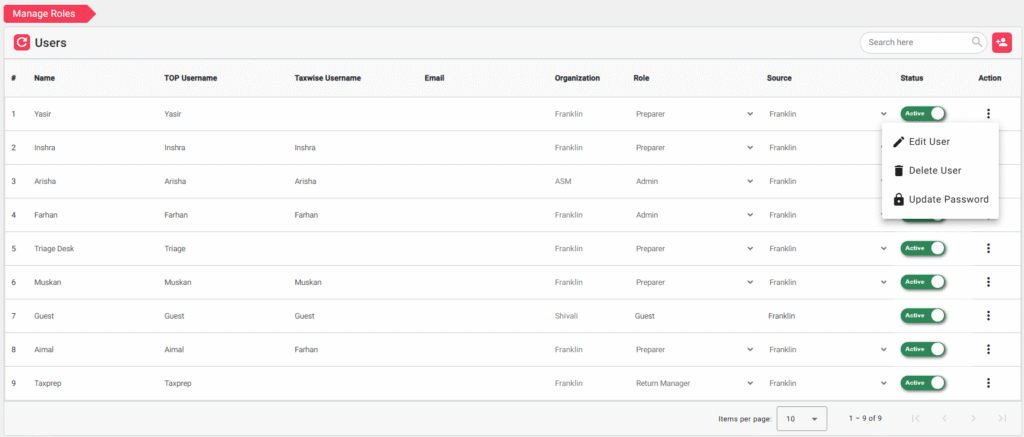

Manage Your Team

Easily manage your team’s access and permissions with our flexible Role Management feature. From a central interface, you can view all active and inactive users in your office, along with their assigned roles and current status.

This centralized control keeps your system secure, ensures proper segregation of duties, and helps maintain clear accountability across your team.

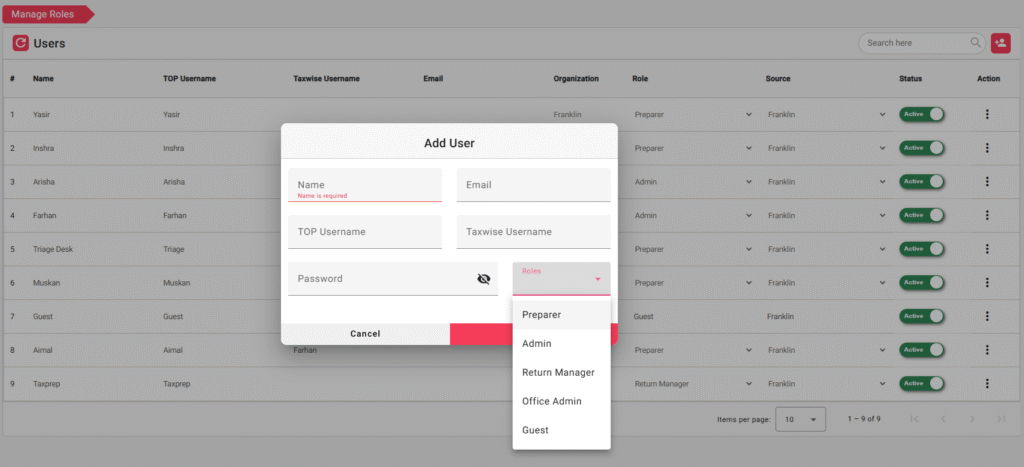

Add New Users

Quickly create accounts for new team members, assigning them the appropriate role and permissions based on their responsibilities and access requirements.

Activate/Deactivate Users

Control system access instantly by enabling or disabling accounts as needed. Perfect for managing seasonal staff, contractors, or team members on leave.

Customize Roles

Assign roles based on responsibilities, ensuring each user has access only to the sections and functions relevant to their work. Create custom permission sets for maximum flexibility.

Everything You Need to Run a Modern Tax Office

From client onboarding to final submission, TOP provides a comprehensive suite of tools designed to streamline operations, ensure compliance, and drive growth for tax professionals.

Ready to transform your tax practice with cutting-edge technology? Join thousands of tax professionals who have already streamlined their operations and increased their revenue with TOP’s comprehensive platform.